What to know before buying or leasing a car

October 6, 2017

From the moment they step on campus for the first time, college students have already racked up debt in student loans. Which is why, once the issue of transportation comes into play, most students do not know where to turn.

College students are often racked up to their ears in debt by the time they reach their second year of college. While student loans are always a concern in the back of a student’s mind, the thought of transportation eventually comes into play.

The decision of deciding to buy or lease a vehicle should be carefully thought out. There are many options to choose from when approaching a dealership and each situation has its own peaks and downfalls, often starting with the problem of a decent credit score.

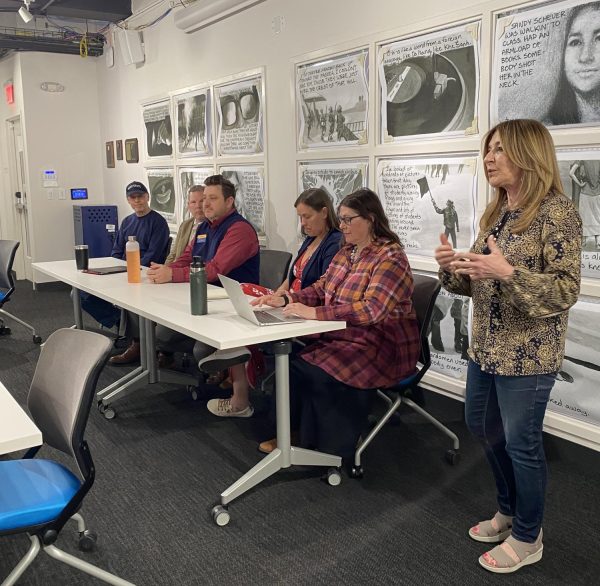

“One thing that is difficult for students is the student loan debt that they are carrying, it eats up a lot of available credit,” said Beth Roe, a credit counselor and educator at Consumer Credit Counseling Services. “A lender can look at them and find risk because they have $30,000 or $40,000 in student loan debt to pay and now they are asking for another loan for $20,000 or $30,000 for a vehicle.”

“There are many options available to college students, the one sometimes limiting factor would be credit,” said Rich Klaben, the president of Klaben Auto Sales. “There are many credit programs out there designed strictly to enable college students and/or graduates to attain attractive credit terms and credit without a cosigner so that they are on the same terms that they would be if they already had credit established.”

While good credit is almost always a must, students can still find a vehicle with a somewhat low credit score.

“A student could possibly still get a car without a good credit score but through a predatory lender,” Roe said, “but they would charge a much higher price for a low-grade vehicle at a much higher interest rate, which raises monthly minimum payments in a loan.”

Once a line of credit is established, there are three choices students can choose from to attain a vehicle. The first option is to purchase a pre-owned vehicle, but with this option comes a few risks.

Buying a vehicle outside of its first three years of life often means you are out of the maintenance safe zone and will eventually have to start replacing simple things on the car such as tires, brakes, rotors and various filters. Replacing these parts will be necessary in keeping the vehicle running smoothly, and will add a few costs to your monthly budget.

When purchasing a used vehicle, be sure to choose a certified vehicle with a factory warranty.

“The factory warranty is a warranty that goes with a product that can’t be bargained or sold,” Klaben said. “It can’t be taken off of the product unless the product is abused.”

The next option for college students is to buy a new vehicle.

“Unless you have a substantial down payment and can afford payments of a new car,” Klaben said, “you are not only indebting yourself for more money, but you are indebting yourself for a long time.”

While there is nothing wrong with this option, be cautious of the commitment you are signing yourself up for.

“There are so many things that are going to change and you really don’t know where your long-term plan is going to take you, so your best plan is to avoid that long-term exposure,” Klaben said.

The third option available is to lease a new vehicle.

“If you are going to lease, you do not want to sign a lease longer than 36 months,” Klaben said.

“Anything longer than 36 months defeats the purpose of leasing, and you should just go buy a car.”

Leasing is an important option because it is short-term. With a short-term lease, there is less exposure and you aren’t tied down to an option for the rest of the vehicle’s life.

“With a lease, essentially what you are doing is buying part of the vehicle. You are indebting yourself less than 3 years and you are buying the best part of the car,” Klaben said. “You have a vehicle for x amount of years and you know roughly how much you are going to spend on it total and there is no changing it.”

Leasing also provides the comfort of driving a new car without needing to fork out the cash for extensive maintenance repairs – most of which are covered under a leasing warranty.

“Overall, you need to find a vehicle that is going to fit both your needs and your budget,” Klaben said. “If I were a college student, I would be leasing a car, because it would give me the peace of mind of a new car and my monthly payment would be my maximum exposure. It takes all of the uncertainty out of it without locking yourself in long-term.”

While the decision is up to you and your unique situation, keep in mind these components when looking for your next vehicle.

Angela Radesic is the student finance and jobs reporter. Contact her at [email protected].