Guest column: Levying a tax on sugary drinks is a sweet deal

March 12, 2012

Whether in the form of Gatorade to replenish electrolytes after a hard workout, 5-Hour Energy to get through a long day of classes or Pepsi to get a short-lived energy boost at work, we’ve all experienced the benefits of drinks with high sugar content. In moderation, the drinks appear helpful — hardly harmful — but how would you feel if your favorite sugary beverage were taxed?

Well, if you live in one of the 33 states that currently taxes soft drinks at a mean rate of 5.2 percent, you probably don’t mind too much. The tax rate is too low to deter consumers from buying soft drinks, which are a cause for international health concern.

It is common knowledge that obesity has become an epidemic in recent years, with approximately 12.5 million children and adolescents classified as obese. But what effects have sugary drinks had on this figure? Is the harm significant enough to create a heavy tax? From a public health perspective, the answer is clearly yes.

More studies are emerging around the world on the effects of sugar on the body. While the term “sugar high” is loosely used in common culture, it actually may not be too far from the truth. One study conducted at the University Bordeaux in 2007 examined how rats react when exposed to water sweetened with saccharin and intravenous cocaine. The rats were given both substances with increasing doses of cocaine to the point of addiction. The study found that a shocking 94 percent of the rats preferred the taste of the sweetened water as opposed to the cocaine. This clearly displayed the addictive potential of intense sweetness.

As if the higher sugar consumption isn’t bad enough, it is correlated with a significant decrease in milk consumption. Rates of heart disease and diabetes have also increased in a similar pattern to the sugary beverage line. The influence of media, targeted advertising, availability and the relatively low cost of sugar drinks have all added to the tempting trend to switch out healthier alternatives for less expensive ones. But what if drinking healthier were more cost-efficient?

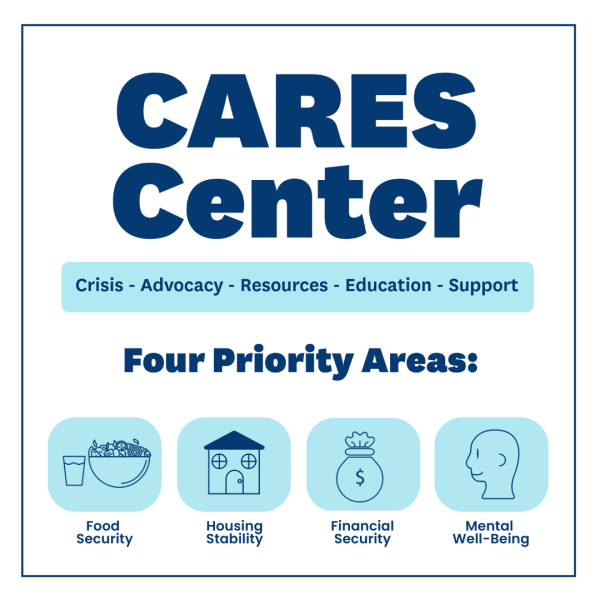

If a tax of one cent per ounce is placed on sugary drinks, the state of Maryland alone would generate about $243,933,134 if people still decided to buy the products, according to calculations from the Yale Rudd Center for Food Policy and Obesity. The kind of revenue gained could be used to create access to healthy beverages and foods in socioeconomically challenged areas where obesity-related illnesses run rampant due to a lack of affordable food choices. Over time, people won’t feel the need to spend extra money for sugary beverages when healthier, more affordable alternatives exist. This could very well create a domino effect for positive healthy lifestyle changes and reduced incidence of disease.

Having an occasional soft drink will not pose a threat to your health, but, when thinking of the accumulative results displayed by the rat study, it is easy to make a small treat turn into an unhealthy habit. A sugar tax seems to be the most viable solution to help stimulate lasting changes that will make people think twice before taking a sip of that soda.

Read more here: JOHNS HOPKINS

The Johns Hopkins News-Letter, Johns Hopkins U. via UWIRE