What does Kent State own?

Graphic by Taylor Rogers.

December 6, 2011

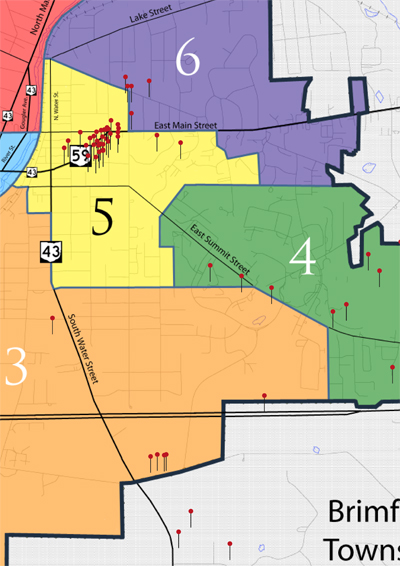

From the vacant houses along College and Lincoln streets waiting to be flattened for the Esplanade extension project, to the swamp lands sitting behind Dix Stadium — 721 acres rest in the hands of Kent State.

Those acres represent the university’s newest and oldest buildings, its plans for expansion and its years of growth.

But it also represents tax money lost in the city of Kent to be put toward local schools.

Because of the university’s status as a nonprofit, it is exempt from property taxes — money that would go into the city’s budget and the local school district’s budget if it wasn’t tax-exempt.

Dan Smith, economic development director for the city of Kent, said the city doesn’t suffer as a result of the university’s presence. In fact, it’s quite the contrary.

Different kinds of ownership

According to the Portage County Auditor’s website, the university can own a piece of land in different ways:

Kent State University Foundation: The Foundation is a separate, nonprofit charity. Jim Watson, associate university counsel, said it exists for the benefit of the university, so it can buy a plot of land and give it to the university or keep it for its own uses.

Kent State board of trustees/Kent State: If the board of trustees or the university wants to purchase land, it must first go through the state controlling board, which can approve or reject the university’s request.

Kent State board of trustees for its endowment: Watson said the university purchases these types of lands, which are usually investment properties, out of interest-bearing funds or gifts. They are owned by the university and require no involvement from the state of Ohio.

“While we don’t get the property tax, the employees and the payroll taxes — the income taxes — that we get are significant,” Smith said.

About $10.6 million of the city’s $35 million budget comes from income taxes, and roughly 36 percent of that $10.6 million comes directly from the university.

“(The university) creates a stability in the city of Kent,” Smith said.

Local businesses also benefit from Kent State. Smith said they always look forward to the fall when students return, as that essentially means roughly 27,000 additional customers, along with the nearly 3,500 faculty and staff members the university employs.

“I think when you look at the big picture, all combined, all the economic activity and the types of businesses and folks that want to locate around the university, I think there’s a big net gain from the loss of just not having the property taxes,” Smith said.

But Kent City Schools doesn’t see the same tradeoffs.

Deborah Krutz, treasurer for the district, said it does lose out, but it’s a loss they’ve always dealt with.

“It’s always been that way,” she said. “For the past 100 years, Kent State has been here, and it’s always been tax-exempt, so it’s not a matter of a loss; it’s more a matter of, you know, this is our reality.”

Krutz said Kent City Schools has qualified for additional special state aid since 1995 because of the amount of tax-exempt properties within the district. More than 25 percent of the properties within Kent City Schools, including the university-owned land, is exempt from property taxes.

The state aid the district receives helps only to a point.

Properties in Kent exempt from property tax:

Franklin Township and Akron’s water treatment plant

Kent Social Services

Churches

Nonprofit organizations

Buildings owned by the city

Total acres in Kent: 4,032.067

Total acres of the 4,032.67 acres in Kent exempt from property taxes: 1,239.754

*Information provided by Janet Esposito, Portage County auditor

Total acres the university owns (exempt from property taxes): 721.1881

Total properties: 91

Largest property: 102.12 acres

Smallest property: 0.0859 acres

*Information provided by the Portage County Auditor’s website.

“It certainly does not make up for all of the taxes if that property were to be tax-generating,” Krutz said, adding the aid is in a transition period as Ohio Gov. John Kasich is working on a new school funding program.

Krutz said she couldn’t estimate on how much that aid will be.

Contact Taylor Rogers at [email protected].

Contact Caitlin Restelli at [email protected].