Budgets strain student diets

March 12, 2009

Some stretch money in attempt to find healthy meal choices for less

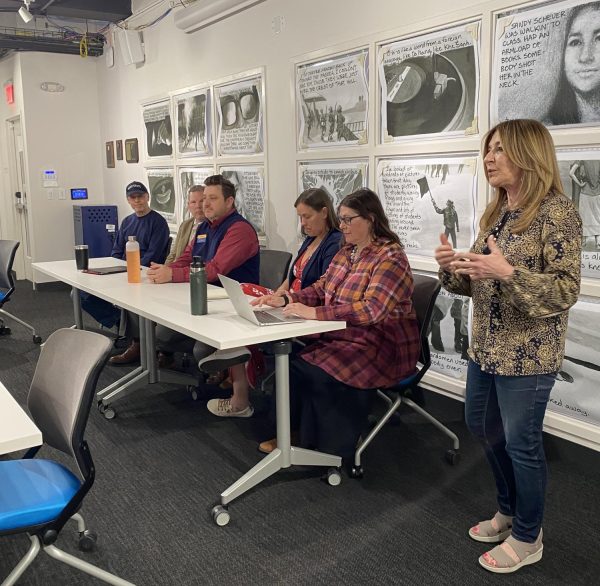

Lauren Goik, junior fashion merchandising major, points to the empty shelf of the cabinet she shares with her roommate on Tuesday in her apartment. “I normally have toast but I don’t have it this week,” she said. ”It’s been a busy week.” Brittany Ankro

Credit: DKS Editors

Stephanie Crompton, a junior nursing major, lived in a Columbus apartment last year and ate only couscous and frozen brussel sprouts.

“My mom didn’t believe that I only spent $12 per week on food,” Crompton said.

Crompton struggled to afford groceries to create a balanced meal. She said she was able to stretch the couscous for two to three days and tried to save $3.89 a week to afford a trip to Cold Stone Creamery.

Crompton jokes that her diet was well-rounded.

“There were dairy, veggies and grains,” Crompton said. “Sometimes I would steal a sip of orange juice from my roommate: There’s fruit.”

She’s one of the students who claim they can’t afford to buy groceries to create healthy, balanced meals.

In the fourth quarter of 2008, consumer spending on food fell 3.7 percent, according to data from the Department of Commerce’s Bureau of Economic Analysis.

“On more than one occasion, I’ve put off my electric bill so I could have money to eat,” said Lauren Goik, junior fashion merchandising major.

Goik said it’s rare if there is anything in her fridge besides coffee.

“I have a quick cup of coffee before class then try to forget I’m still hungry throughout the day,” Goik said.

When she does go to the grocery store, she buys apples and a loaf of bread for toast. Goik said she can stretch the loaf of bread out to last more than a week.

Jodie Luidhardt, coordinator for the Nutrition Outreach Program at Kent State, believes it is possible for students to eat healthy on a tight budget with a little extra planning and time.

“Many students use the excuse that healthy food costs too much and settle for purchasing cheaper, not so healthy foods,” Luidhardt said.

Luidhardt warns unhealthy eating habits can have serious effects on a student’s health.

“A poor diet may lead to nutrient deficiencies, a weakened immune system and weight gain,” Luidhardt said. “Excessive weight gain or obesity puts a person at risk for diabetes, high blood pressure, heart disease, cancer, depression and premature death.”

“Saving a few dollars now may not be worth the medical cost of some of the diseases associated with poor diet.”

Crompton admits her diet of couscous and brussel sprouts wasn’t healthy.

“I learn about health for my major,” Crompton said. “I should have realized it wasn’t healthy, but it’s what I could afford at the time.”

Tabatha Riegler, director of product, marketing and content for Monster.com’s Making It Count Program, a program which helps students learn budgeting tips, says coupons are an excellent way to save a little money at the grocery store.

“I personally use coupons as often as I can. Coupons.com has some great coupons you can print and use,” Riegler said. “I’m also a fan of the coupon sections in the Sunday paper. I have been able to save as much as 50 percent off my grocery bill before by using coupons and store loyalty cards.”

Luidhardt recommends students buy fruit and unprepared vegetables, which are generally cheaper.

“(Fruit) is part of a healthy diet and can be affordable as well,” Luidhardt said. “Usually a bunch of bananas will cost less than a dollar, and a bag of apples will cost less than $5.”

Another budget-friendly option is sandwiches.

“Sandwiches can be healthy and affordable. Buying a loaf of whole-grain bread and a jar of peanut butter may cost $5 and will surely provide nine or so snacks or meal components,” Luidhardt said.

Both Luidhardt and Riegler suggest planning before a trip to the grocery store to check for coupons and sales and to compare the sticker price of brand names versus store brands.

“It’s ironic that I’m a nursing major and have to help treat malnourished patients,” Crompton said. “I’m glad I learned my lesson before the table was turned and I would have to be the one being treated.”

Contact student finance reporter Kristyn Soltis at [email protected].