About 74% of undergraduate part-time students and 40% of full-time students were employed in 2020, according to the most recent data found by the National Center for Education Statistics.

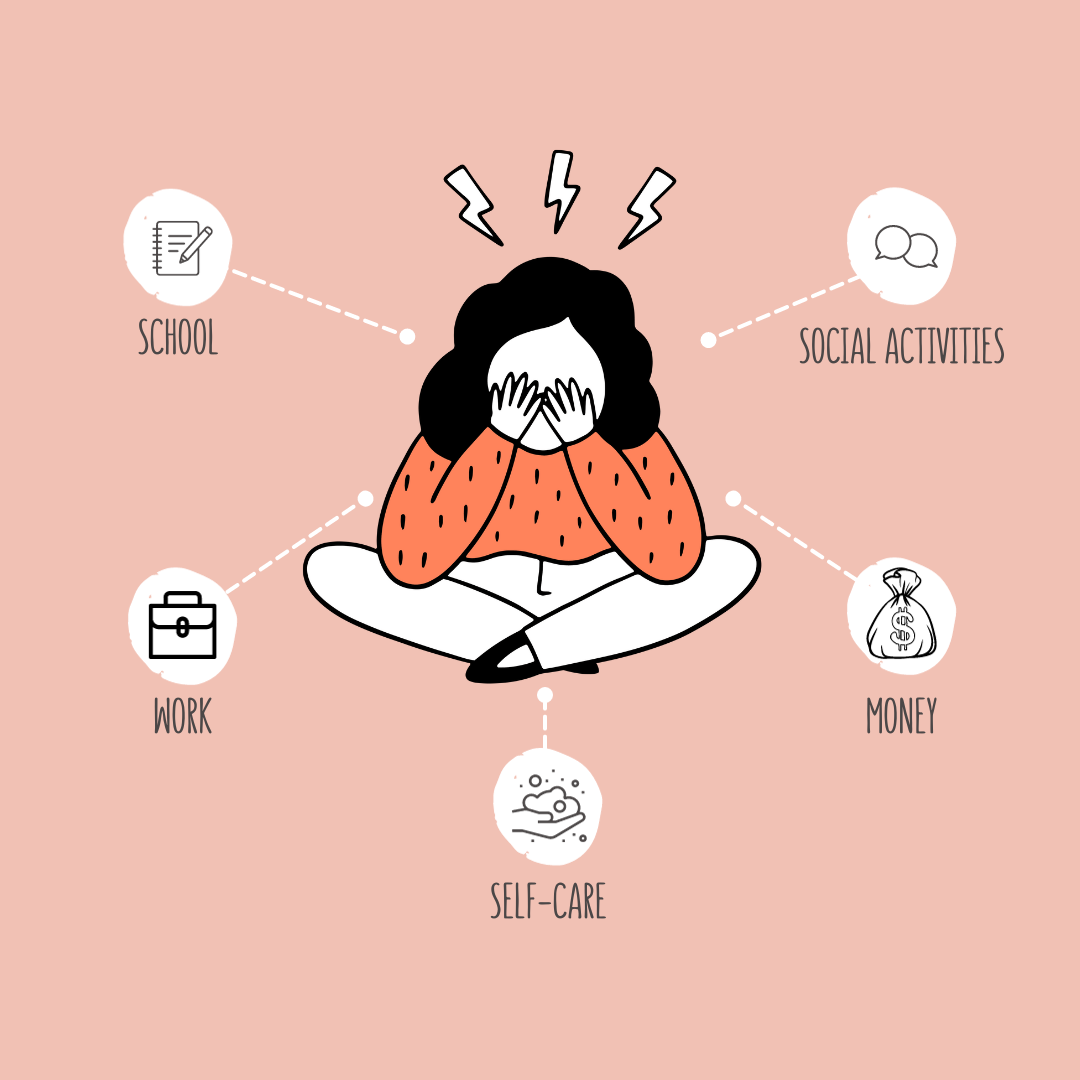

While employment can be essential for covering living expenses and basic needs, some students like senior visual communication and design major Aiden Hartong find themselves overwhelmed by the demands of academics and work.

Hartong said he works 20-30 hours a week while trying to finish his degree.

“Over the past year, my mental health struggles have made my employment very inconsistent,” Hartong said. “I think that makes me worry about money more.”

Hartong said students often find themselves burned out by the constant worry about money as they navigate the challenging demands of higher education.

“I live paycheck to paycheck,” Hartong said. “It’s just like a balancing act.”

Some students find themselves overwhelmed by the pressure to excel academically while keeping up with work obligations.

Senior criminal justice major Sami Kelley works two jobs while attending school. She said she can only fit three shifts in a week to make time for schoolwork. Social activities are even harder to plan for, she said.

“I have to set aside a small amount of money for things like that to make sure I can pay for Ubers and drinks,” Kelley said. “It starts to become more of a worry rather than fun.”

In 2022, The College Board released statistics that say 54% of college undergraduates finished college with student loan debt. The average borrower has over $37,000 in federal student loan debt.

“We’re taking out money to pay for college, then having to pay back more than what we borrowed in the first place,” Kelley said. “It’s impossible to save right now, and next I have to worry about that.”

Students like Kelley can only work so many hours throughout the week in order to make time for classes and homework. This limited time causes limited income.

“The other day I went to work in the morning then grocery shopping after,” Kelley said. “I only made $3 that day because I spent the rest on groceries.”

Some students face the reality of needing a job to support themselves and their education. Working around class schedules, social activities and studying can be a challenge and mentally exhausting, but students like Kelley cannot escape this reality.

“I try not to worry about the things I can’t control,” Kelley said. “It’s really hard not to, but at least the feeling of making my own money makes me proud of myself.”

A list of mental health and well-being resources for the Kent and regional campuses can be found on the university’s Mental Health website.

Chloe Wilson-Henline is a reporter. Contact her at [email protected].