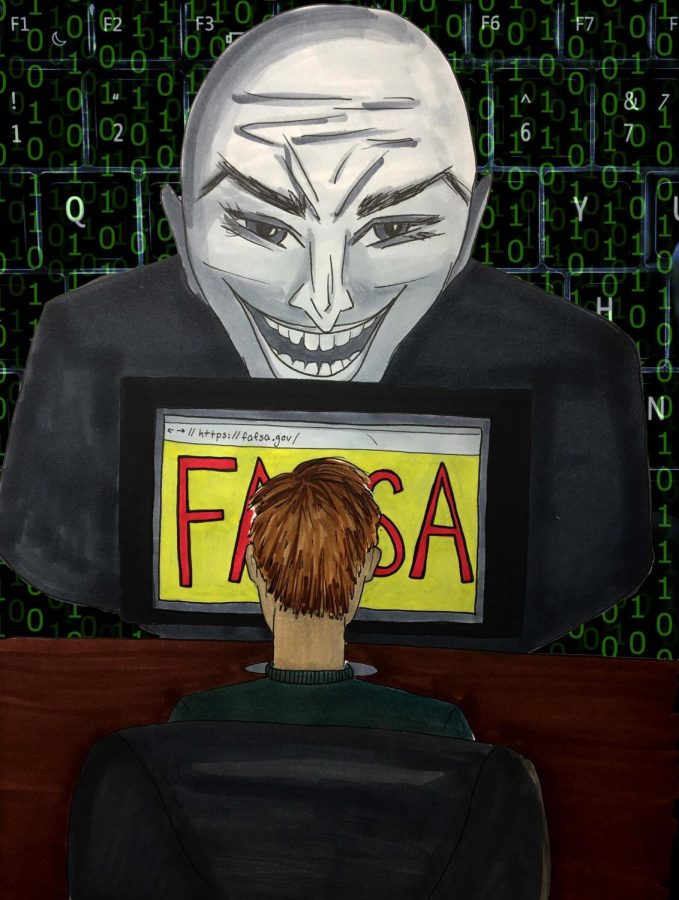

FAFSA fumbles with student identity theft

April 9, 2017

Although hackers compromised FAFSA’s IRS portal, David Garcia, senior associate vice president for Strategic Enrollment Management, said Kent State students shouldn’t worry about their applications.

“Kent State will not see a big impact, as many families completed the FAFSA before the tool went out of order,” Garcia said. “For those who are still in the process, our best advice is to complete the FAFSA the old fashion way, which is to use your tax forms as a reference for the sections that require IRS information.”

FinAid, a financial student aid guide for students, reported the Internal Revenue Service Data Retrieval Tool has been a key feature of FAFSA for eight years. The system allows students and their families applying for financial aid to automatically fill in the FAFSA with online IRS tax return information.

The FAFSA is still available, but the IRS and Federal Student Aid (FSA) shut down the tool in March and are currently investigating possible accounts of identity theft to notify taxpayers who may be affected, according to the U.S. Department of Education.

It’s currently unknown how many accounts could be affected by this security issue.

“Students should expect the tool to be down until the start of the next FAFSA season in October,” said Beth Maglione, the National Association of Student Financial Aid Administrators (NASFAA) vice president.

The organizations are putting taxpayer accounts on hold to provide additional security and prevent further identity fraud.

Since the establishment of the tool, students — like junior interior design major Megan Phillips — are able to fill out the FAFSA with more ease because it provides accurate information from the past year’s tax information.

“I’ve been using the IRS Data Retrieval Tool for years now,” Phillips said. “It really helps a lot when filling out the long application, especially since I don’t have immediate access to my parents’ tax information.”

Students may struggle filling out the form without the tool. This may cause a disruption of applications being submitted this month, since February, March and April are when the majority of FAFSA applications are submitted to schools, according to the Education Policy Initiative at the University of Michigan.

“We are working as quickly as possible to resolve these issues,” said Alberto Betancourt, media and customer relations press officer for the U.S. Department of Education. “The IRS is working diligently with (FSA) to get the tool up and running again.”

The FAFSA application is centered around the IRS data retrieval tool and the verification process so more students may be chosen for providing additional documentation for verification, NASFAA president Justin Draeger stated in a press release.

Students chosen for the verification process are required to submit additional documentation to prove the information on their FAFSA is accurate. This can cause additional time for the FAFSA to be successfully submitted without all the required paperwork, which can include a paper copy of last year’s tax return, pay stubs and a verification worksheet.

Samuel Calley, a senior business management major, knows this first hand. Calley applies for federal financial aid every year using the FAFSA, but just references the past year’s tax returns and manually fills in the application.

Although Calley sees the IRS Data Retrieval Tool as unnecessary, he has been a victim to the extensive verification process.

“I’ve been ‘randomly chosen’ for two years now to provide additional documentation to verify my FAFSA,” Calley said. “It’s just annoying. I think the verification process is very excessive and just another stress factor while attending school.”

Students chosen for verification who need a copy of last year’s tax return can go online to www.irs.gov/transcript or call 1-800-908-9946 to receive a transcript in the mail within five to 10 business days.

Several states around the country are coming up close for deadlines to submit the FAFSA, according to Sarah Pingel, senior policy analyst at Education Commission of the States. Ohio has an extended deadline so students can seek help filling out the application.

“The State of Ohio’s FAFSA filing deadline for state grant eligibility is Oct. 1 … the Data Retrieval Tool delay should not have a direct impact at the state level for students,” said Jeff Robinson, director of communications for the Ohio Department of Higher Education.

Even with the extended deadline, students who use the IRS Data Retrieval Tool may have trouble filling out the FAFSA without information being automatically filled in.

Ariana Mantas, a sophomore marketing major, views the tool being inaccessible as an annoyance for her and her family.

“We waited (until) only a couple of weeks ago to start filing out the FAFSA application,” Mantas said. “Now without the tool available, I’ll have to travel back home a couple hours away to sit down with my parents to reference last year’s tax return. This is very inconvenient, especially with the end of the school year approaching.”

Kent State offers students and their families financial literacy workshops throughout the year. A FAFSA advice workshop is one of several information sessions given, while more topics include loans and scholarships, money management, financial decision making and credit card advice. Although there are none scheduled for the remaining semester, students can seek help from the university’s Financial Aid Office.

The financial aid office is welcoming all students who may need assistance filling out and submitting their FAFSA applications. There are several computers in the office where students can sit down with a financial advisor to get help on the application.

“Around 80 percent of Kent State students have successfully filled out and submitted their FAFSA applications,” said Mark Evans, director of Student Financial Aid at Kent State. “Our doors are open for any students who may need assistance or have questions regarding the application.”

Students and families who need help filling out their FAFSA can visit https://studentaid.ed.gov/sa/fafsa or call 1-800-4FED-AID (1-800-433-3243) for assistance.

Mikala Lugen is the student finance reporter, contact her at [email protected].