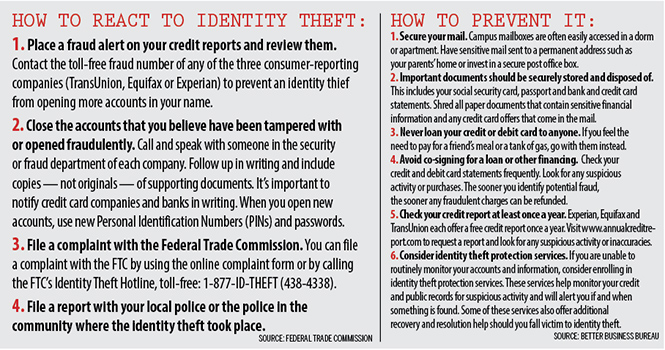

Tips to prevent identity theft

September 9, 2012

Melissa Scaglione was in class with about 30 other students her freshman year when someone stole her laptop from inside her backpack.

“I have the worst luck,” said Scaglione, a junior entrepreneurship major.

At the time, however, she didn’t realize just how unlucky she was because her laptop wasn’t the only thing she would lose.

A few months after Scaglione reported the theft to police, $400 disappeared from her personal bank account to pay for concert tickets in Cleveland.

College-age adults like Scaglione made up 23 percent of identity theft victims in 2011 — the largest percentage of any age group — according to the Consumer Sentinel Network database.

“I think maybe my passwords were in [my computer],” Scaglione said. “It makes no sense to me how you can steal someone’s information. I have iTunes, but I don’t make other online purchases — ever.”

Quick Facts

56,689 people between the ages 20 and 29 were identity theft victims last year.

These college-age adults made up 23 percent of the total identity theft complaints in 2011 — the largest percentage out of any 10-year age range.

This age group is most susceptible to friendly fraud — when the victim actually knows his or her perpetrator.

Source: Better Business Bureau

Pam England, marketing director at Portage Community Bank, said something like an iTunes account would provide more than enough information for an identity thief.

“Someone can actually steal your identity with just your name and address,” England said.

Scaglione said the bank froze her account and mailed her paperwork to complete and return. The bank then had to approve the paperwork before Scaglione could access her money again.

“I was in Kent and didn’t have any money,” she said. “I called the bank, and I was like, ‘Well, can I at least have money now? Like, $100? I’m not home; I don’t have my parents around.’ And they were like, ‘No.’ So, I had to borrow money from people because I literally had not a dollar because my account was frozen.”

England said it’s the bank’s “due diligence” to protect its customers. Banks will often close identity theft victims’ accounts, freeze their debit or credit card activity and have them open new accounts.

Scaglione did get her money back a few weeks after she returned her paperwork, but said the process was a huge inconvenience.

“I had to get new cards. I had to get new passwords. I had to get new everything,” she said.

Contact Alyssa Morlacci at [email protected].