Federal court strikes down Biden’s student loan forgiveness program

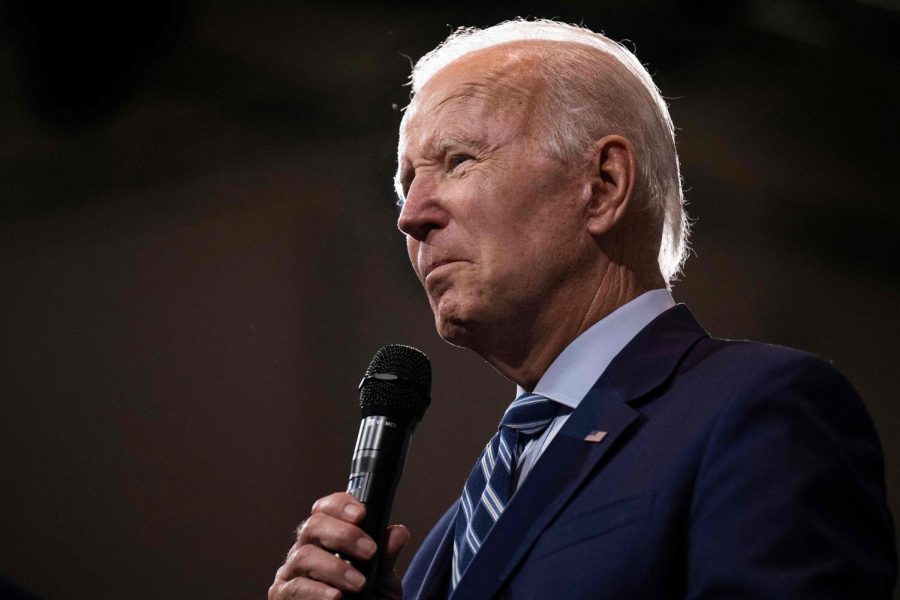

President Joe Biden speaks at Wilkes University in Wilkes-Barre, Pennsylvania, on August 30. A federal judge in Texas has struck down Biden’s student loan forgiveness program, declaring it illegal.

November 10, 2022

(CNN) — A federal judge in Texas has struck down President Joe Biden’s student loan forgiveness program, declaring it illegal.

The lawsuit was filed by a conservative group, the Job Creators Network Foundation, in October on behalf of two borrowers who did not qualify for debt relief.

Biden’s program was already on hold due a separate legal challenge.

The Biden administration has argued that Congress has given the secretary of education the power to broadly discharge student loan debt in a 2003 law known as the HEROES Act.

But the Texas federal judge found that the law does not provide the executive branch clear congressional authorization to create the student loan forgiveness program.

“The program is thus an unconstitutional exercise of Congress’s legislative power and must be vacated,” wrote Judge Mark Pittman, who was nominated by then-President Donald Trump.

“In this country, we are not ruled by an all-powerful executive with a pen and a phone,” he continued.

A White House spokesman did not immediately respond to CNN’s request for comment.

Nearly 26 million student loan forgiveness applications had been submitted as of last week, but the Biden administration has been banned from canceling any debt since the 8th US Circuit Court of Appeals put an administrative hold on the program on October 21.

The appeals court has yet to rule on that lawsuit, brought by six Republican-led states. A lower court judge dismissed the lawsuit on October 20, ruling that the states did not have the legal standing to bring the challenge.

The Biden administration is facing several other legal challenges to the program. Supreme Court Justice Amy Coney Barrett has denied two separate requests to challenge the program.

Under Biden’s program, individual borrowers who earned less than $125,000 in either 2020 or 2021 and married couples or heads of households who made less than $250,000 annually in those years are eligible to have up to $10,000 of their federal student loan debt forgiven.

If a qualifying borrower also received a federal Pell grant while enrolled in college, the individual is eligible for up to $20,000 of debt forgiveness.

In the case ruled on Thursday, one plaintiff did not qualify for the student loan forgiveness program because her loans are not held by the federal government and the other plaintiff is only eligible for $10,000 in debt relief because he did not receive a Pell grant.

They argued that they could not voice their disagreement with the program’s rules because the administration did not put it through a formal notice-and-comment rule making process under the Administrative Procedure Act.

“This ruling protects the rule of law which requires all Americans to have their voices heard by their federal government,” said Elaine Parker, president of Job Creators Network Foundation, in a statement Thursday.

The advocacy group was founded by Bernie Marcus, a major Trump donor and former Home Depot CEO.

Payments on federal student loans have been paused since March 2020 due to a pandemic-related benefit. They are set to resume in January.

This story has been updated with additional information.