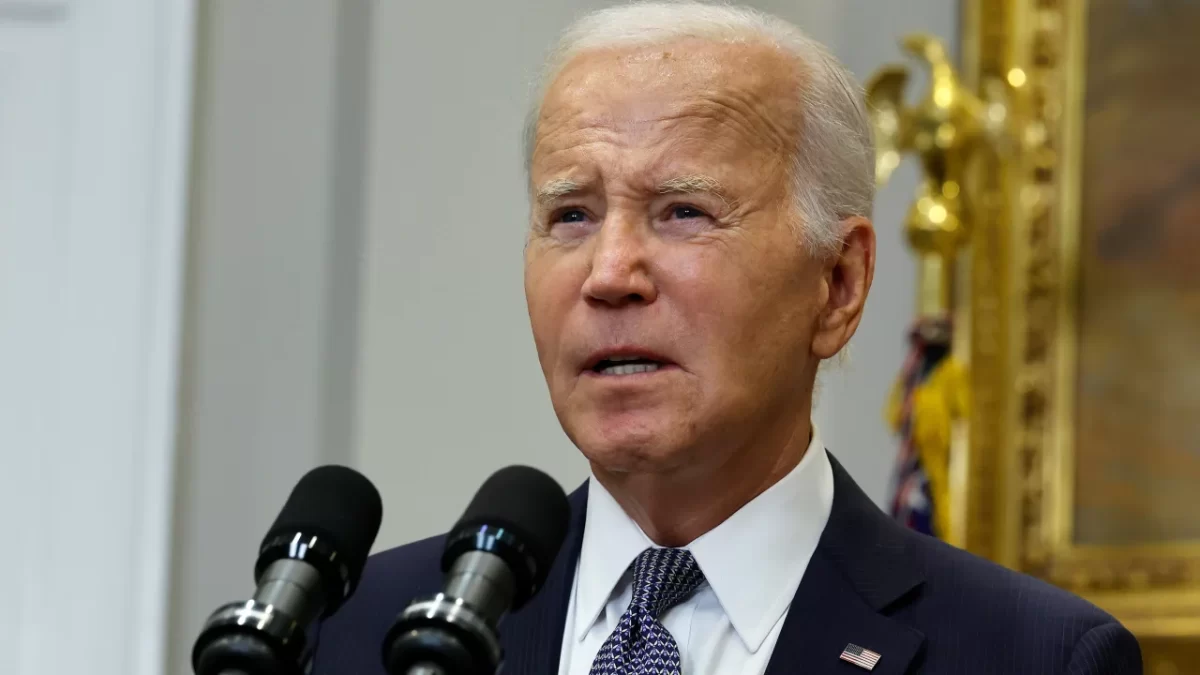

Washington CNN — The Biden administration is making another attempt to create a new student loan forgiveness program and released some details Monday about the types of borrowers being considered for eligibility.

The administration is in the very early stages of developing the new program. A finalized proposal isn’t expected until 2024, and the student debt relief effort could still face legal challenges.

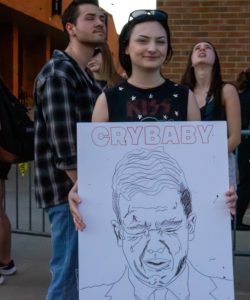

President Joe Biden’s first student loan forgiveness proposal, which promised up to $20,000 in debt relief for low- and middle-income borrowers, was struck down by the Supreme Court in late June.

After the defeat, Biden vowed to pursue a different path to delivering student loan forgiveness, based on a different law, the Higher Education Act.

The new pathway requires the Department of Education to undertake a formal rulemaking process, known as “negotiated rulemaking,” which typically takes months.

A committee of outside negotiators – including borrowers, schools and student loan servicer representatives – is tasked with meeting several times during October, November and December to discuss the proposal and provide input on the regulatory language.

The public also has an opportunity to weigh in. A draft rule is expected to be released next year.

A new student loan forgiveness program is unlikely to benefit the same borrowers that the initial program would have.

The Department of Education said Monday that four groups of borrowers are being considered for eligibility, including those who:

- Currently have balances bigger than what they originally borrowed.

- Entered repayment at least 25 years ago.

- Attended career-training programs that created “unreasonable debt loads or provided insufficient earnings for graduates” or that have an “unacceptably high student loan default rate.”

- Are eligible for existing student loan forgiveness programs but have not applied.

The Department of Education also released a paper Monday aiming to guide the negotiators’ November discussion toward including borrowers who are experiencing financial hardship that the current federal student loan system does not adequately address.

“President Biden and I are committed to helping borrowers who’ve been failed by our country’s broken and unaffordable student loan system,” Education Secretary Miguel Cardona said in a statement.

That’s more student loan forgiveness than was granted under any other administration – in part due to the Biden administration’s efforts to temporarily expand some debt relief programs and to correct past administrative errors made to borrowers’ student loan accounts

Among the existing student loan forgiveness programs are the Public Service Loan Forgiveness program, which wipes away outstanding student loan debt for public-sector workers who’ve made 120 qualifying payments, and borrower defense to repayment, which aims to provide debt relief to those defrauded by their college.

The Biden administration tried to implement a new student loan forgiveness program before the yearslong pandemic-related pause on payments ended, but the Supreme Court’s decision hindered that timeline. Payments resumed this month for about 28 million borrowers for the first time since March 2020.