Fiscal Cliff avoided, various effects on students

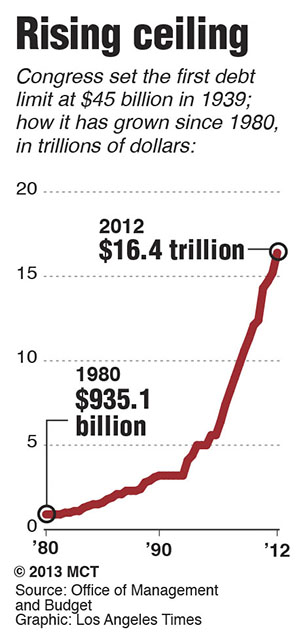

Graphic courtesy of MCT Campus.

January 31, 2013

Senate leaders and the White House struck a deal on Dec. 31, 2012 to avoid the impending fiscal cliff.

The fiscal cliff was the almost immediate decline in the budget that would have occurred at the beginning of 2013 due to required spending cuts and various tax increases as stated in the Budget Control Act of 2011.

The Budget Control Act of 2011 raised the national debt ceiling, which is similar to a credit card limit, and because of this various spending cuts and tax increases were required.

“[Congress] came to a deal to stop that but they put off other issues like mandatory cuts that need to be made in government programs and the debt ceiling,” said Richard Stanislaw, Kent State political science assistant professor. “Vice President Joe Biden and Sen. Mitch McConnell, who is the minority leader of the Senate, were two of the main leaders behind the deal.”

With this new reduction of tax increases and an increase spending, the national debt will approach the limit, or debt ceiling, quicker than expected and will probably need to be raised again.

There would have been various ramifications for the country as a whole had the fiscal cliff not been avoided.

“Our economy is weak and the government would have stopped spending if we had gone over the metaphorical cliff,” Stanislaw said. “If the government stops spending, then there’s less movement in the economy and that’s bad for the nation both long term and short term.”

However, this could definitely have an effect on college students.

“The longer the budget is just renewed each year rather than overhauled, the more debt we go into,” said Leah Wilson, sophomore pre-nursing major and member of College Republicans. “This puts more pressure on our generation who will have to pay it off and ultimately makes it harder for us to succeed in the future.”

The effects of the fiscal cliff, while avoided, could still have a lasting effect on college students.

Part of the Congressional deal which avoided the fiscal cliff included keeping the tax deduction on student loan interest, which means college students will not have to pay as much in taxes for their student loans. However that is less revenue for the government and therefore hurts the national debt.

“The effects could be very direct,” Stanislaw said. “There could be, or more than likely will be, cuts into various government programs such as the Pell Grant.”

There could also be indirect effects for students as well, Stanislaw said.

“If research money from the government to universities is cut then that money has to come from somewhere,” Stanislaw said. “That means there might need to be a tuition increase for students in which case some students might not be able to afford college, a cut in professors and therefore larger class sizes, or more cuts into loans.”

Contact Katie Nix at [email protected].