The Supreme Court’s decision to strike down Biden’s student loan forgiveness plan is often framed as a question of presidential powers and what a president’s authority truly entails.

Throughout the Biden, Trump, Obama, Bush and every other administration, the issue isn’t how much power the position entails, but it rather comes down to if Congress or SCOTUS is aligned with the specific issue or the president’s beliefs.

While the branches’ respective powers must be reevaluated and reinforced, it was merely a convenient reason to strike down the student debt relief plan.

So no, SCOTUS is less concerned with whether Biden and Kamala have the authority to enact debt cancellation, and they are far more concerned with the potential $400 billion it would cost the government.

What their decision really called into question is not a new worry.

Why doesn’t the federal government value education?

Why do they prefer to allot over $800 billion as the 2023 National Defense budget, while the Pentagon can only account for 39 percent of $3.5 trillion in assets?

A large concern is how the canceled debt would be paid. Of course, the total would add into the federal deficit right away, but what would happen from there?

There are only two options: decrease spending or increase taxes.

As the reapportionment of taxes towards the wealthy is looking rather unlikely, that leaves one not-so-simple solution. While there are many areas of the government’s budget that could easily be cut down on, or simply dealt with more responsibly, it would likely decrease the budget from necessary social programs, like Social Security, housing subsidies, reduced school lunches or child care assistance.

While the military budget grows higher each year alongside the country’s debt, in all likelihood, increased funding for any social program or debt relief is going to detract from the other, rather than where the unnecessary money is truly being spent.

The U.S. government’s priorities have long been deviated from what they ought to be, and their resources have been unbelievably poorly used.

While student loan debt cancellation may not appear to be the most prudent manner of dealing with the mass of debt Americans have taken on which totals to around $17 trillion, according to research made by debt.org. There aren’t many elegant solutions left.

Looking to the future, increased funding for public higher education and free access to community colleges would go a long way in providing essential career-building skills and a workforce that is able to meaningfully contribute to the economy without concerns over massive amounts of student loan debt.

For many, the idea of a college education is an impossibility—an opportunity reserved for athletes, those with an unbelievable amount of merit scholarships, and those who have parents willing to pay for and support them throughout college—at least, it’s impossible without taking out student loans.

While there certainly are some incredible success stories, a classic underdog who fought all the odds and came out on top, they are the minute minority and tend to serve as inspiration rather than a realistic example.

We can help future students have easier access to higher education, but even if that increased funding and support for community and state colleges is done federally soon, what about all of the past students? The ones who are still paying interest on their student loans decades after graduating?

The ones who starved themselves through college and saved wherever they could in the hopes of a strong start in life?

So many students don’t qualify for any form of financial aid beyond a small federal loan because of their parents’ money, but they have no help in paying for college. Students that receive financial aid often have to take out loans, regardless.

When they come out the other side with tens or hundreds of thousands of debt, what support are they offered?

Even as higher education is pushed more and more as an essential step after high school, once a teenager has taken on that burden of debt, it is fully their responsibility. Beginning to pay off loans in an entry-level job, or even in graduate school, is often a very difficult task to accomplish while maintaining a decent quality of life.

While I may not disagree with the general principle of taking responsibility for your actions, I do find the expectations placed on young people to be extreme, particularly when those massive responsibilities follow you far past college.

The level of student debt in our country is proof that the current system is not functional, and those who have already been hit with the brunt of it should not bear the responsibility for that.

However, SCOTUS was far more concerned with companies’ bottom lines.

The majority opinion held that Biden was overreaching his powers, and that MOHELA (The Missouri Higher Education Loan Authority) would lose approximately $44 million in fees associated with federal student loans service through the company. This one example proved to be more than enough, with Chief Justice John Roberts saying Missouri’s proof of legal standing was enough and there was no need to investigate any other states.

However, legal experts pointed out that MOHELA’s debts are not the state’s debts—notably, MOHELA could also sue on its own—but the court did not take MOHELA’s standing issue too seriously, which might serve as a dangerous precedent.

That simple solution and quick finding that Missouri had standing may have been due more to a dislike of a case and a hope for swiftly striking down the plan.

Although the court found that there would be harm caused by the loan relief policy, the evidence for that being true is somewhat lacking. Kagan in particular strongly disagreed with the finding, as MOHELA’s revenue loss is entirely their own and wrote in her dissent “the state’s treasury will not be out one penny because of the secretary’s plan.”

The other primary issue on the table was whether the Heroes Act allowed for such a sweeping cancellation of debt. While it absolutely allowed for student loans to be manipulated, the majority held the powers granted underneath the Act did not stretch so far.

The Act allowed for such powers during national emergencies—with the ordeals and severe money loss that came along with COVID, Biden argued student loan relief was necessary to lessen the burden and return individuals’ financial statuses to what they were before the pandemic.

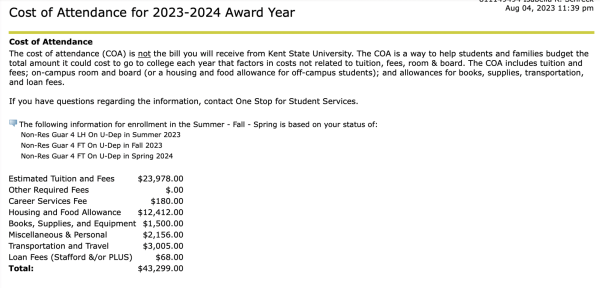

Computer screenshot of Kent State University’s Flashline website / The Kent Stater

The MOHELA finding was rather weak, and their interpretation of the Heroes Act was, in the eyes of many, a stretch. So why would striking the forgiveness plan win in a 6-3 vote when there had been little controversy over pausing the student loan payments?

The payments were paused under both the Trump and Biden administrations, showing it wasn’t a bipartisan issue, as total student loan forgiveness appears to be. On a divisive issue like this, it isn’t uncommon to see a bill struck down or passed simply in opposition to the other party.

Beyond that, conservatives are more likely to want to preserve the military budget and favor tradition. As seen yet again with the recent argument over the debt ceiling, both parties are more than willing to make a harmful decision so long as it blocks a goal from the other.

While the courts are meant to be immune to political issues, that has never been the case with the Supreme Court. By its very nature, it is a divided bipartisan group that decides on high-profile cases almost only along party lines.

Regardless of any prejudices, with no form of student loan forgiveness offered as the debt payments start up again, there will be a record number of defaults and late payments as many have still not financially recovered from the pandemic.

While the issue on the table may be new, the argument or the format is the same as it’s been for the last couple of centuries. Bipartisan politics are so strong in the U.S. that every new problem is seen as black and white, win or lose. While that may benefit lobbyists and politicians, it does nothing but harm the people they are intended to serve.

Student loan forgiveness would benefit so many and would relieve a huge financial burden for many college graduates that cannot afford it. However, despite Biden speaking up against the SCOTUS decision and hoping to find another way to fulfill his candidacy promise, it is unlikely that any middle ground will be found.

There is no simple or perfect solution to the debt crisis, but an absolute refusal to act at all will only worsen the issue. Despite the claims the majority put forth as proof the plan could not be enacted, their decision had very little to do with what was discussed in court, and it had much more to do with previously held biases and allegiances unrelated to the topic being discussed.

Regardless of any federal plans or decisions, the students who have taken loans off and the graduates struggling to repay them will continue to have an impossible task ahead of them until definitive action is taken.

So many benefited from the pause in debt payments, a necessary respite that allowed for more money to be spent on necessities in a time of unanticipated inflation, or for money to be saved up to prepare for paying off debts, allowing them to be paid without penalty or even defaulting.

However, despite the obvious benefits and the relief that loan forgiveness would provide, it will be a long road.

Discussions of free community college and reduced tuition for state schools have been a frequently heard debate for years. Biden’s plan for free community college costs $90 billion, a $310 billion difference from the estimated cost of student loan forgiveness.

While debt forgiveness is still on the table, offering free community college might mean the federal government was spending less on education-related costs down the road. However, this plan seems unlikely to make it through Congress, facing fierce opposition from the right, even as many relentlessly campaign for more accessible education.

The student loan moratorium will definitely not be extended by the Biden administration again either, but as hopeless as the situation may look, especially for those who were relying on the student loan forgiveness plan being enacted or the suspension of payments, there remains the possibility of student loan forgiveness in the future. This plan has been struck down, but there is no intention of Biden or others who support it to let the issue go.

The Biden-Harris Administration has already put forth two new programs to aid in student loan debt—programs that will provide a significant amount of aid for those who were relying upon debt cancellation.

The SAVE plan is designed to ease borrowers back into payments on their loans by allowing them to choose a feasible, income-driven repayment plan for them. The website will fully launch in August, replacing the REPAYE program. Rather than applying yearly, users will only have to apply once under the SAVE plan.

For a single borrower earning up to $32,805, they will be eligible for required monthly payments of $0 a month. Once payments have been made consistently for 10 years, there is the possibility of full cancellation of the rest of your debt.

There’s more good news for long-term payers: approximately 804,000 borrowers that represent a cumulative $39 billion in federal student loans have been notified their loans will be automatically discharged. This initiative ensures there is an accurate count of qualifying payments made under income-driven repayment plans, and applying loan forgiveness for those who have made payments for 20 or 25 years’ worth of qualifying months.

Despite these important steps, this leaves many borrowers with tens or hundreds of thousands of dollars that they still must pay off.

Hopefully next time, the decision is based more out of concern for the country’s citizens and the longevity of their financial well being than bipartisan politics and prejudices.

Virginia Doherty is an opinion writer.

Contact her at [email protected].

Pissed off tax payer • Aug 17, 2023 at 4:48 pm

The tax payers should not be paying off and student loans and biden better be not pushing it or maybe him and hunter should pay it with the money they got from China the traders