Students talk financial fears, solutions

December 2, 2017

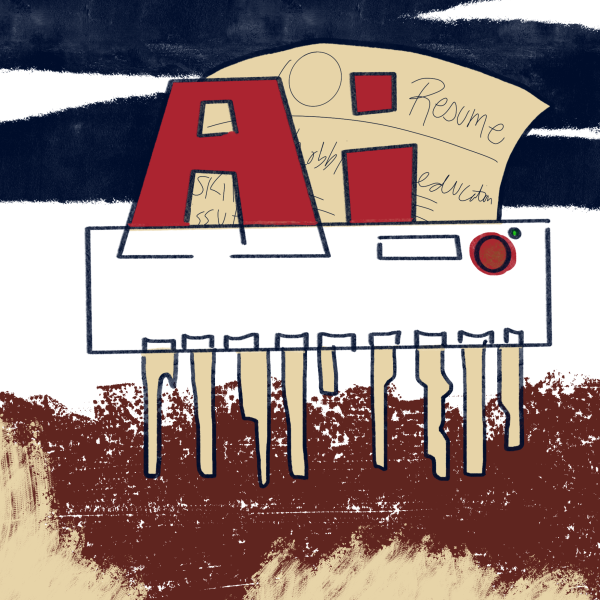

While every student has a different financial situation, one thing applies to almost all students — college will almost always leave you with some sort of debt.

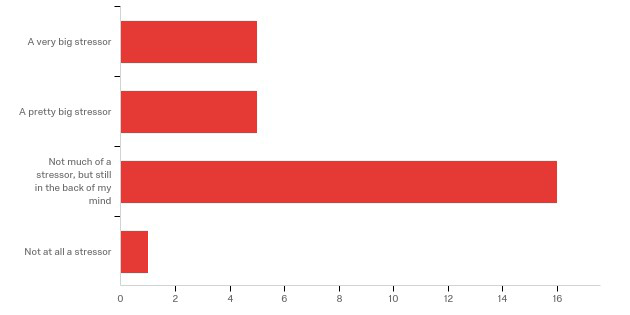

When it comes to those attending a college or university, the most commonly thought about fear is typically debt or student loans.

According to an article published by Make Lemonade, the average college student in 2016 graduated with $37,172 in student loan debt.

With the average student loan debt ranging from $30,000-$40,000 and increasing every year, college students have statistics like these as a constant reminder while in school.

For Rachel Caraffi, a freshman psychology major, debt after college was the issue she was most worried about when starting at Kent State.

“My biggest financial fear upon entering college was the amount of debt I would accumulate over the course of going to school here,” Caraffi said. “I have to pay my tuition each year by myself, without the help of my parents. In saying this, there was a lot of financial pressure placed on my shoulders upon coming to college because I wanted to make sure I saved up enough money to afford my first year.”

Caraffi doesn’t currently have a job, but she plans to get one during spring semester to help with other costs while in college.

“I believe it’s important to have (a job) throughout college,” Caraffi said. “Any money you can make during the time you’re at college will help you in the long run.”

While debt is one of the top financial fears of college students entering and currently enrolled in a college program, it is not the only financial issue students fear. For freshman mathematics major Emma Stec, her biggest fear is losing her scholarships.

“My biggest financial fear is losing my scholarships because they’re helping me pay for college,” Stec said. “I try to relieve my fear by focusing on my schoolwork.”

According to Student Loan Hero, it was written that the average amount of scholarships and grants given to students that attended a four-year college was $7,010.

For students to uphold a scholarship or grant, they need to obtain good academic standing. Keeping up with grades while being a member of different organizations on campus and obtaining an internship can be difficult and is a concern for those fortunate enough to have scholarships.

College students all over Ohio have different financial worries that accompany them in college.

For Michael Cooch, an Ohio State sophomore data analytics major, he said his biggest worry is debt, but he doesn’t like to dwell on that problem while in school.

“I don’t focus on my debts,” Cooch said. “They do not have to be repaid until six months after I graduate, so I will have time to pay them off.”

When facing a stressful financial situation, he goes to his dad for advice.

“He’s put four kids through college so he already knows how each of them financially did it,” he said. “Therefore, he can help me with any issues I have.”

Relatives, financial planners and financial aid employees are all people to turn to in times of financial difficulty. All students have financial fears, and it is important to have resources in times of trouble.

“To help cope and relieve (my financial fears) I put into perspective the reality of my situation,” Caraffi said. “It is inevitable to accumulate debt through college and that I eventually will run out of my savings and have to take out loans. … I make smart spending choices and work whenever I can to continue saving up money for my next tuition payment.”

Angela Radesic is the jobs and finance reporter. Contact her at [email protected].